As an experienced fund administrator, Linnovate understands the unique requirements and challenges facing venture capital funds. We offer tech-enabled fund services tailored to the needs of VC fund managers, providing you with the support and expertise to focus on your core investment activities.

Our service and tech approach is designed to scale with the growth of your venture capital fund. We offer flexible service packages that can be tailored to your specific needs, whether you are launching a new fund or looking to transition an existing one.

Streamlined onboarding of limited partners, comprehensive KYC/AML checks, and investor communications.

Precise and timely financial statements, NAV calculations, and investor reports.

Management of all investment transactions, capital calls, and distributions.

Streamlined subscription and redemption processes, clear investor communications, and detailed capital account maintenance.

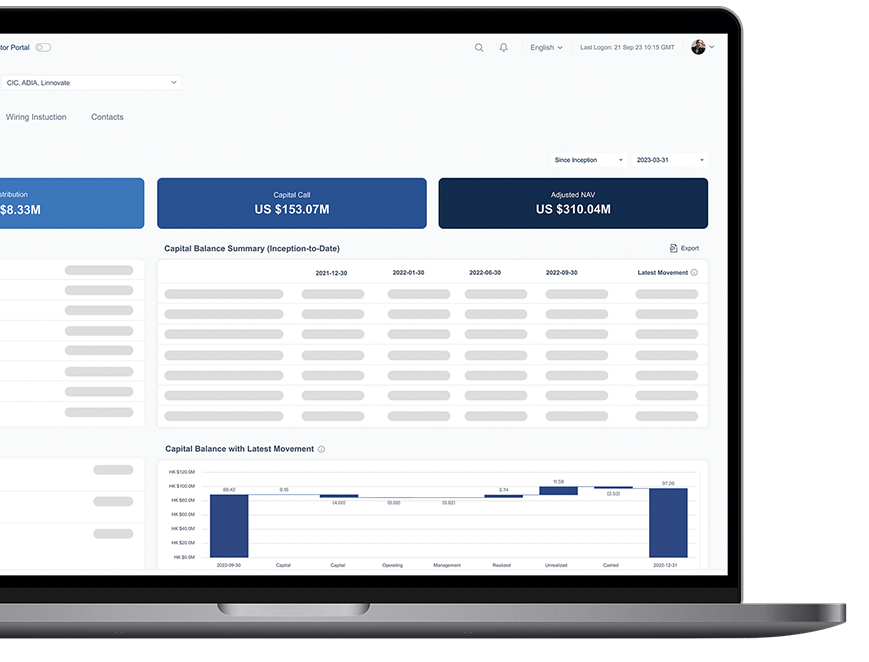

Advanced fund administration platform, customizable reporting, automated processes and secure data management.

RAISE automates routine administrative tasks, reducing manual errors and freeing up your team to focus on strategic activities.

Gain real-time access to fund data, allowing for timely decision-making and enhanced transparency.

Generate customizable reports tailored to your specific needs, providing you with the insights necessary to drive your fund’s performance.

RAISE ensures the highest standards of data security, protecting sensitive information and maintaining compliance with regulatory requirements.

Our platform is designed to scale with your fund, accommodating growth and evolving needs without compromising on efficiency or accuracy.

Our team of high-caliber professionals possesses a diverse range of talents, with solid experience in various areas of alternative asset servicing, including fund administration, financial technology, and corporate services.